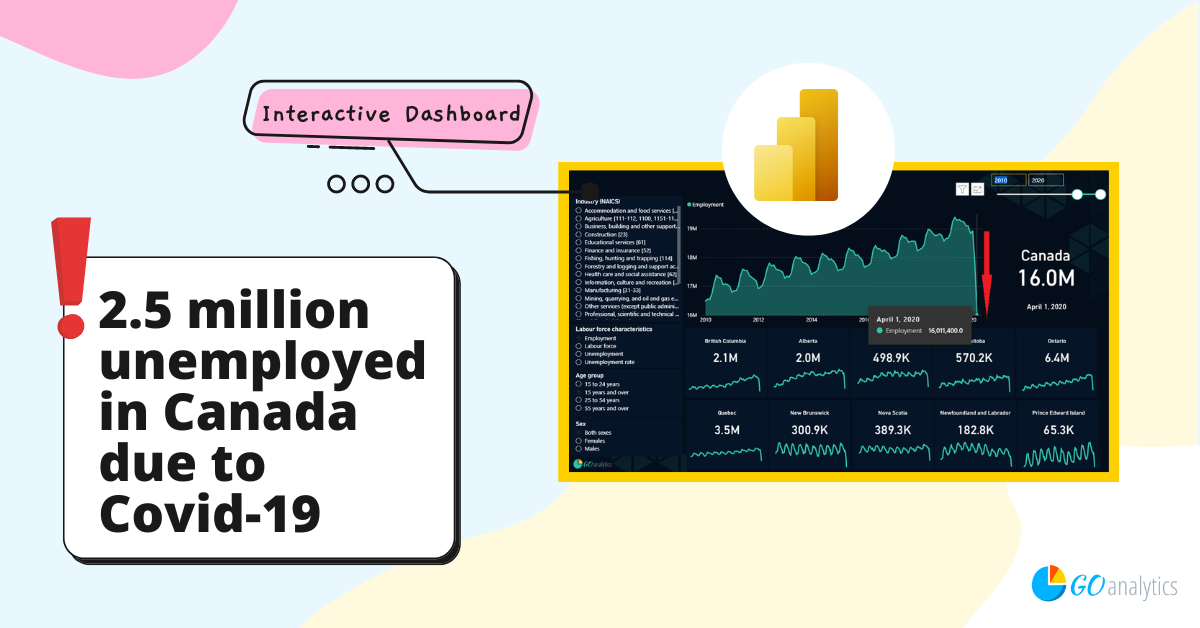

We have successfully been flattening the infamous curve and have just recently began taking steps to “reopen” the Canadian economy. But not without an economic cost. The latest release of Statistics Canada’s Labour Force Survey (LFS), released last Friday (April 8, 2020), indicated that in the month of April there were 2.5 million unemployed workers in Canada. For a simple comparison, this is 40% higher than the highest level ever recorded in the history of the LFS (1.8 million in March 1993).

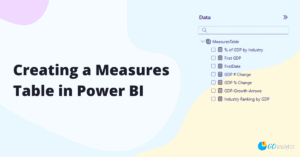

Employment in Canada declined by 2.8 million (-15.1%) jobs in April 2020 compared to the same month a year ago, triple the decline of 1 million in March. This sharp decline in demand for workers caused unemployment rates to increase to 13.5%, again one of the highest levels ever recorded in the LFS which dates to 1976. See the graphic below.

In my last blog post, where I tracked the Canadian labour force results for the month of March, I went a little deeper into the demographic variables at play such as differences between age groups and gender. At a high level, women and younger workers have been the hardest hit in terms of labour market outcomes during this pandemic as they tend to be concentrated in the industries that have experienced significant declines in demand.

For more detailed information on demographics see “COVID-19 wipes nearly 1 million jobs from Canada’s economy”, but for this post I wanted to dive a little deeper into the impact for specific industries.

In the month of March some industries felt minimal or no impact, while some others continued to grow their labour pool. These included industries like agriculture, construction and finance and insurance, health care and social assistance, and manufacturing to name a few. This was not true for April. As the full impact settled in, nearly all industries in Canada were forced to reduce their staff count. In fact, the only exception was the finance and insurance industry, which added 67,200 (+8.1%) new jobs compared to April 2019.

Canada-wide, the accommodation and food services industry continued to face the sharpest reductions in demand, posting employment declines of 583,000 (-49.2%) jobs while unemployment rate shot up to 36%. For year-over-year change in labour market variables, see page 4 in the graphic above.

Canada-wide, the accommodation and food services industry continued to face the sharpest reductions in demand, posting employment declines of 583,000 (-49.2%) jobs while unemployment rate shot up to 36%.

Other industries in entertainment and tourism also saw strong declines in demand and associated declines in employment. These included the information, culture and recreation industry (-24.2%), retail trade (-22.3%), and other services (-25.1%).

The real estate and rental and leasing industry also experienced significant declines in employment in April, shedding 74,200 (-20.3%) jobs compared to the same month last year as home sales declined and some commercial renters have chosen to close their doors for good. The unemployment rate increased to 7% from 1.3% in 2019.

As we cozied up at home doing our best to flatten the curve in April, we contributed to less injuries and accidents and, in turn, less visits to the Emergency Room. Lower number of visits to the E.R., combined with the closure of specialty clinics during the pandemic, led to moderate employment declines of 170,800 (-7.0%) in Canada’s largest industry, health care and social assistance.

While the goods-producing sector of Canada’s economy was somewhat sheltered from declines in March, amendments to the list of “essential services” and lower downstream demands led to softening labour markets in April. Canada’s fourth largest industry, manufacturing, posted employment declines exceeding 300,000 (-17.7%) workers from a year ago and pushed unemployment rate for the industry to nearly 17%. The mining, quarrying, and oil and gas extraction industry also reduced its staff count by 17%, although some of this decline is likely attributable to oil-price shocks. The construction industry shed 122,700 (-15.9%) workers and saw the number of unemployed workers double from April 2019.

The labour force statistics suggest that the shut down of Canada’s “non-essential services” has worked its way through the entire economy, leaving millions of Canadians out of a job.

Although we are now beginning to see the light at the end of the tunnel, with plans of reopening the economy beginning to surface, it is unlikely that we will return to pre-pandemic levels of activity any time soon. The question now becomes, how many of these lost jobs will be wiped out for good?

Whether we see improvements in the next release of the Labour Force Survey is still uncertain, but one thing is for sure; whether you lost your job or not, there will be financial implications to the pandemic. Just look at the numbers.

Want to build your own interactive dashboard?

Our Microsoft Certified consultants can help with the design, development, and deployment of Power BI solutions

Contact Us

![Read more about the article [How To] Create a histogram and cumulative frequency distribution chart in Power BI](https://goanalyticsbi.com/wp-content/uploads/2022/12/Blog-Feature-Image-Template-2-300x157.png)